Services

Financial Modelling

- Customized Models Based on Key Business Drivers

- Operational/Valuation/M&A/Leveraged Buyouts Modeling Expertise

- Pre-Earnings Drivers Analysis

- Post-Earnings and Event Based Model Updates

- Scenario Analysis

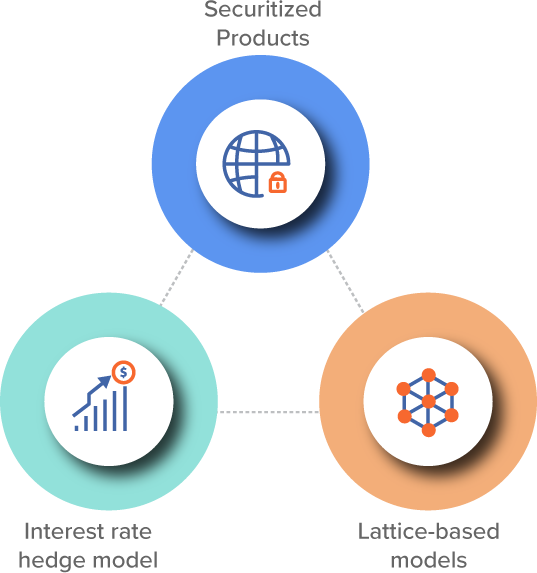

Pricing & Valuation Models

- Securitized Products: CLOs / RMBS / CMBS, Bonds, Convertible Bonds, CDS

- Lattice-based models: Binomial / trinomial models for Equity, Bond Options

- Interest rate hedge model: pull-through linear regression model for residential mortgages

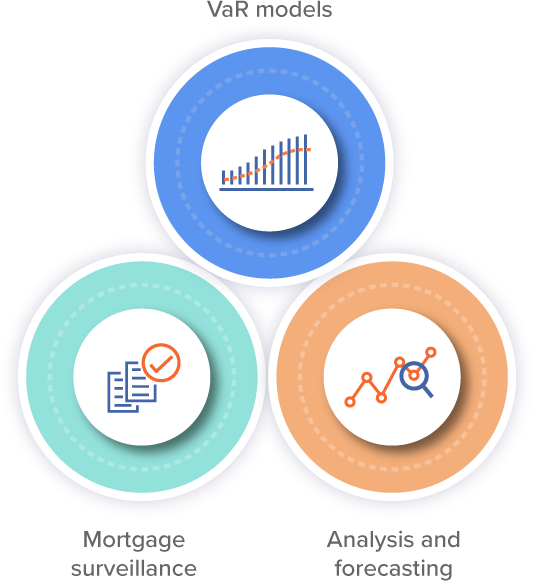

Risk Analytics

- VaR models: Historical / Monte Carlo simulations, hybrid approach

- Analysis and forecasting: defaults, delinquencies,, prepayments, CLOs / RMBS / CMBS deal severities

- Mortgage surveillance: monitoring of key attributes, cure / resolution / roll rates

Credit Analysis

- Debt Structure and Leverage Analysis

- Distressed Credit Screens

- Credit Rating Models

- Covenant and Indenture Analysis

- Yield Comparable Analysis

- Cash Flow and Recovery Model

- Sovereign Credit Analysis

- Country Risk Analysis

Data Analysis

- Reporting and Automation (Excel-VBA-Macros)

- Predictive Modeling

- Text Cleaning and Mining

- Web Scraping (Publicly Available Data)

- Dashboards & Visualization

Regulatory Compliance

- Stress testing / Scenario analyses for CCAR, DFAST, ICAAP

- Reverse Stress Testing – ensuring linkage between Capital and Liquidity.

- BCBS 239 data compliance

Quantitative Analytics

- Develop and test strategies to generate quantitative alpha

- Conduct portfolio performance attribution and risk analytics

- Analyze market neutral, long-short and enhanced index portfolios

Middle Office Solutions

- Reference Data Maintenance

- Transaction Capture

- Validation and Enrichment

- Settlement Support

- Compliance Reporting

- Straight Through Processing